Annual income calculator with overtime

Ad Jacksons Retirement Calculator Tool. If you make 75000 a year your hourly wage is 750002080 or 3606.

What Is Annual Income How To Calculate Your Salary

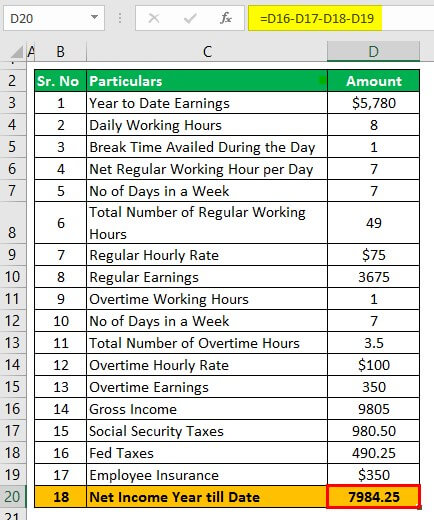

Overtime Hours The amount of hours worked above-and-beyond 40.

. The overtime calculator uses the. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Calculate the approximate number of hours that an.

To calculate your overtime rate of pay you convert the overtime description into a decimal number and multiply your regular rate of pay by the decimal multiplier. To decide your hourly salary divide your annual income with 2080. On the new W-4 you can no longer claim allowances as it instead features a five.

This overtime calculator figures your total overtime paycheck and the OT rate together with the regular pay by taking account of the number of hours worked. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of. Calculate the total wages.

Over the last few years withholding calculations and the Form W-4 went through a number of adjustments. This overtime calculator figures your total overtime paycheck and the OT rate together with the regular pay by taking account of the number of hours worked. Annual Income 15hour x 40 hoursweek x 52 weeksyear Annual Income 31200 Your annual income would be 31200.

Calculating Annual Salary Using Bi-Weekly Gross. Sara works an average of. Assuming you make a hundred thousand dollars in 12 months your hourly wage is 100000 2080 or 4807.

57 rows Here are the steps to calculate annual income based on an hourly wage using a 17 hourly wage working 8 hours per day 5 days a week every week as an example. Using the annual income formula the calculation would be. This calculator determines the gross earnings for a week.

The Overtime Formula The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week. If you work 375 hours a week divide your annual. The adjusted annual salary can be calculated as.

14 days in a bi-weekly pay period. Calculate gross pay before taxes based on hours worked and rate of pay per hour including overtime. Annual Salary Bi-Weekly Gross 14 days.

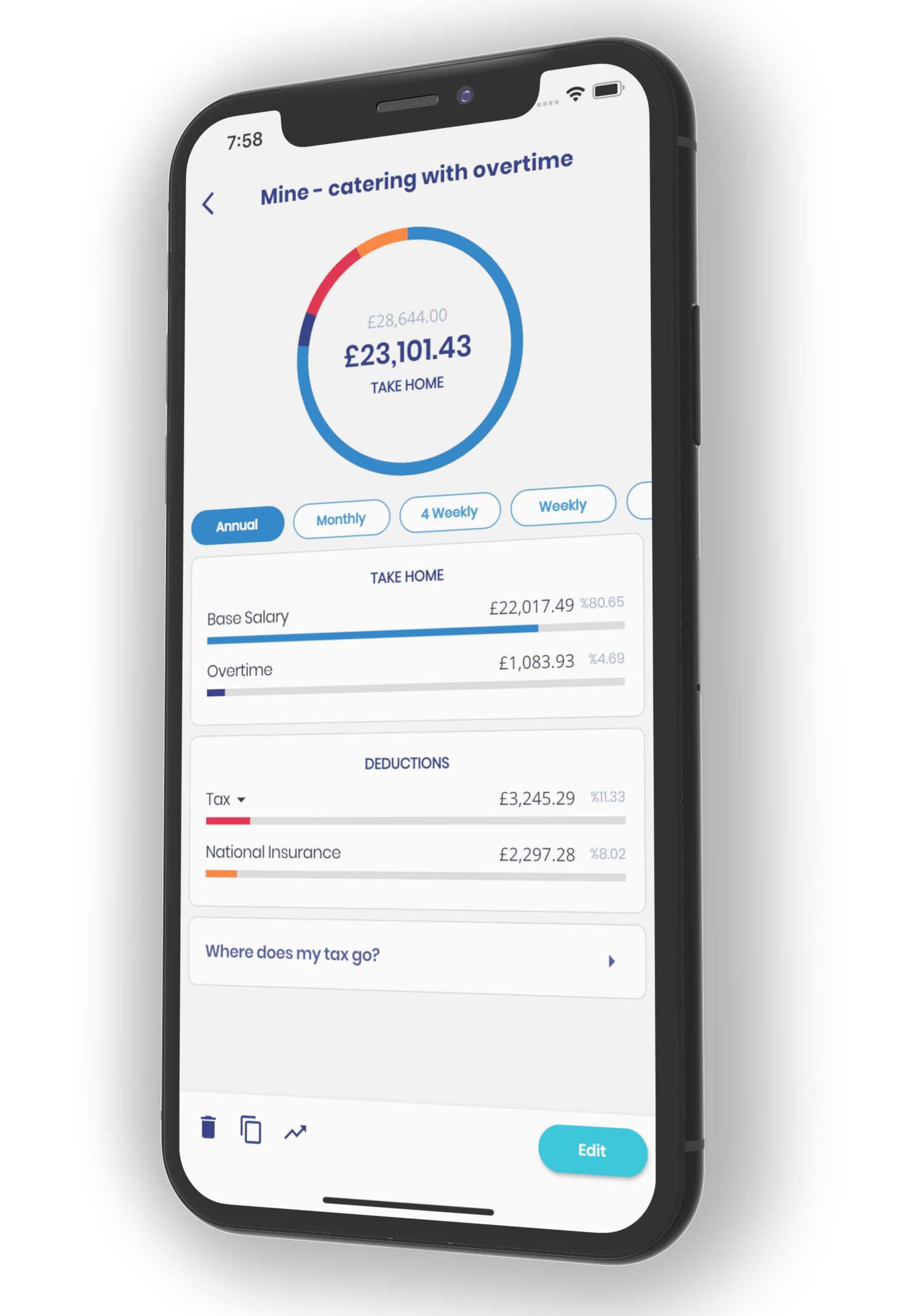

Enter the number of paid weeks the employee works per year. Our Resources Can Help You Decide Between Taxable Vs. Net pay would deduct taxes Social Security Medicare local state and federal taxes health.

Multiply the overtime hourly rate by the number of overtime hours the employee worked. To determine your hourly wage divide your annual salary by 2080. Gross Annual Income of hours worked per week x of weeks worked per year x hourly wage Example Lets calculate an example together.

5 x 10 overtime hours 50 total overtime wages Step 4. 30 8 260 - 25. 365 days in the year please use 366 for leap years Formula.

How to use the overtime calculator Input the employees annual salary. The employees have the. To enter your time card times for a payroll related calculation use this time card.

To determine your hourly wage divide your annual salary by 2080. It does calculate net pay.

Paycheck Calculator Take Home Pay Calculator

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Hourly To Salary Calculator

Overtime Calculator

Paycheck Calculator Take Home Pay Calculator

How To Calculate Wages 14 Steps With Pictures Wikihow

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

4 Ways To Calculate Annual Salary Wikihow

Annual Income Calculator Calculator Academy

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

How To Calculate Wages 14 Steps With Pictures Wikihow

Overtime Calculator To Calculate Time And A Half Rate And More

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Overtime Calculator Workest

Hourly Paycheck Calculator Step By Step With Examples

Salary Calculator App

Hourly To Salary What Is My Annual Income